‘Bipartisan,’ trimmed down special session tax bill gets House approval

Called the largest tax relief package in 20 years, end-of-session negotiations produced a tentative agreement between leadership and the governor calling for $660 million in tax relief over the 2018-19 biennium.

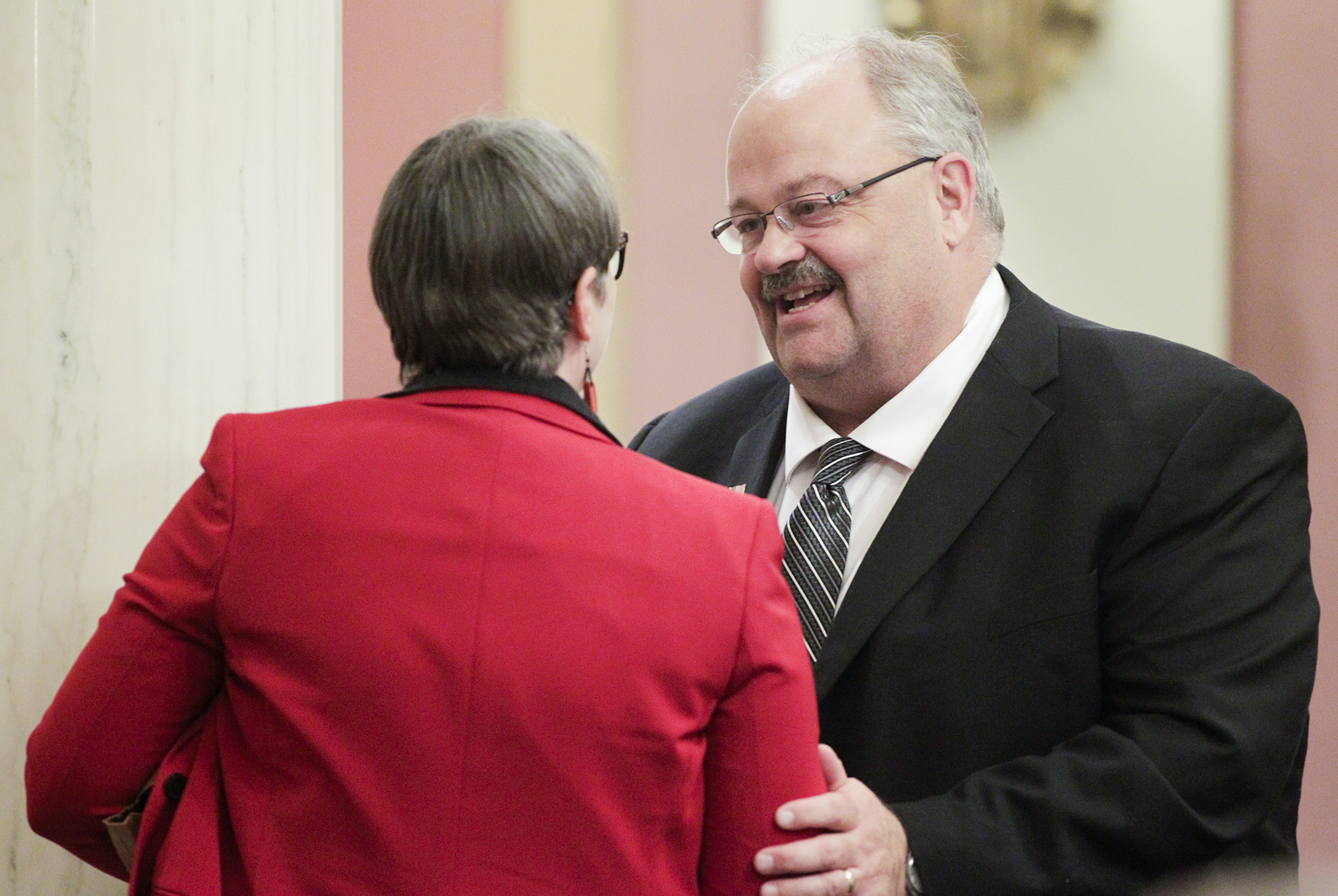

Sponsored by Rep. Greg Davids (R-Preston) and Sen. Roger Chamberlain (R-Lino Lakes), HF1 was passed by the House 102-31 at the break of dawn Wednesday and sent to the Senate.

Republicans came into the 2017 session hoping the state’s projected $1.65 billion surplus would mean money returning to state taxpayers. However, the $1.15 billion omnibus tax bill passed during the regular session was too rich for the governor and met with a swift veto.

End-of-session negotiations produced an agreement between leadership and the governor that $650 million would go to tax relief over the 2018-19 biennium.

The bill, nearly half the size of its predecessor, comes with a lot changes – in some cases it was just nibbling around the edges, and other proposals were dropped from the mix entirely. In total, the bill proposes almost $451.54 million in relief over the 2018-19 biennium in various tax credits and approximately $196.6 million in property tax refunds aid.

“Certainly we wanted more, certainly the citizens needed more. That being said it’s better than nothing and it’s better than a tax increase,” Chamberlain told the tax bill working group Tuesday evening. “Overall it’s a good bill that helps the counties, farmers, students, businesses across the board.”

The lead DFLer on the House Tax Committee Rep. Paul Marquart (DFL-Dilworth) called the bill bipartisan with “a lot of provisions that will help people across the state.” He said the bill’s strength is that it has targeted and strategic cuts.

However, some DFL members think the bill is too large and jeopardizes other parts of the budget.

“I know this is a chief priority of the majority in the House, but it’s too big and sets us up for deficits in the future,” said Rep. Erin Murphy (DFL-St. Paul).

What’s in, what's out

Not in the bill is the controversial effort to give tax breaks to organizations that make donations to scholarship funds for low-income students attending non-public schools. Dayton, called this a “voucher,” and that it would shift funds away from public schools.

There was a significant compromise on the governor’s push to increase the working family credit. The new position makes no monetary increases but lowers the qualifying age from 25 to 21. There was also a negotiated change to the Child and Dependent Care Credit favored by all parties.

Efforts to increase the state’s angel investment credit to help spur economic growth is no longer part of the tax relief mix.

MORE: See the spreadsheet

Provisions to help people carrying student debt or saving for higher education expenses remain in the bill with some changes, including:

- a nonrefundable credit for contributions to a new college savings plan;

- a maximum credit of $500 toward student loan payments; and

- a subtraction for discharge student loan debt.

While not as great an amount as in the vetoed tax bill, this bill would allow a portion of Social Security income to be subtracted from state taxes.

Additionally, qualified first-time homebuyers would be encouraged to establish a savings account for that purpose up to $150,000 and be allowed to subtract from their taxes the interest earned on the account rather that the full amount of their deposits.

Local governments could benefit significantly. Rather than a one-time bump in aid, local government aid and county program aid would be increased annually beginning in 2019 by $15 million and $25.5 million respectively.

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Speaker Emerita Melissa Hortman, husband killed in attack

By HPIS Staff House Speaker Emerita Melissa Hortman (DFL-Brooklyn Park) and her husband, Mark, were fatally shot in their home early Saturday morning.

Gov. Tim Walz announced the news dur...

House Speaker Emerita Melissa Hortman (DFL-Brooklyn Park) and her husband, Mark, were fatally shot in their home early Saturday morning.

Gov. Tim Walz announced the news dur...

Lawmakers deliver budget bills to governor's desk in one-day special session

By Mike Cook About that talk of needing all 21 hours left in a legislative day to complete a special session?

House members were more than up to the challenge Monday. Beginning at 10 a.m...

About that talk of needing all 21 hours left in a legislative day to complete a special session?

House members were more than up to the challenge Monday. Beginning at 10 a.m...