House passes changes to paid leave law amid chaos at close of vote

— UPDATED following House vote

On the first day of 2026, a state-run insurance program is scheduled to begin providing Minnesota workers with up to 20 weeks per year of paid time off to deal with family or medical issues.

But one year after its passage, the Paid Family and Medical Leave Act may be getting refreshed.

Rep. Cedrick Frazier (DFL-New Hope) says HF5363, a bill he sponsors, will ensure the 2026 deadline is met and that the implementation will be smooth.

Republicans have a much different take, saying a smooth launch on the scheduled date is anything but certain for what they say is a fiscally unsound program whose cost is another hurt for small businesses.

The two sides laid out their respective positions during a nearly eight-hour discussion Wednesday.

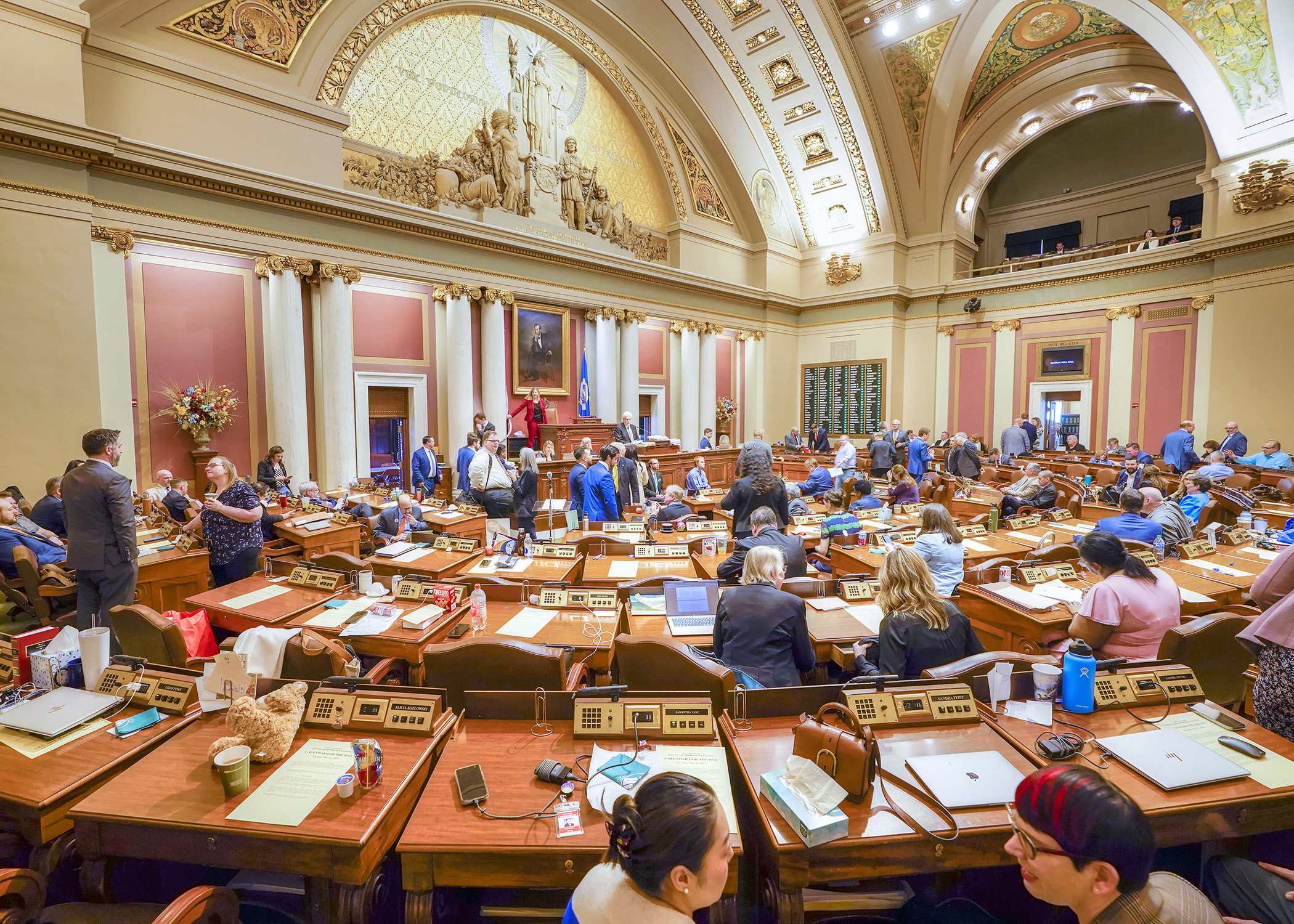

Members eventually passed the amended bill via a chaotic 69-34 vote shortly before midnight and sent it to the Senate. The sudden vote occurred with some Republican members waiting to speak and a cacophony of shouts about process. At least one member could be heard making a motion to adjourn the legislative session sine die.

“It is not the responsibility of the minority to pass the majority party’s bills. It is the responsibility of the minority to make sure the voices of our constituents are represented. This silencing of minority voices is absolutely shameful. This is not a house of 70 members, it is a house of 134, and Democrats are disregarding that,” House Minority Leader Lisa Demuth (R-Cold Spring) said in a statement.

Frazier calls the 2023 law “a great safety net” to keep workers from choosing between staying on the job to collect a paycheck and caring for a loved one.

It establishes a family and medical insurance account modeled after the state’s unemployment insurance fund, including being funded from a 0.7% payroll tax on an employee’s wages, at least half of which must be paid by the employer.

The bill would boost the tax rate to 0.88%.

Frazier said the proposed change is based on an actuarial analysis earlier this year that calculated the 0.88% payroll premium rate would be needed to keep the program sufficiently funded to pay out future claims.

Additionally, the increase is justified, Frazier said, because paid leave benefits would begin during an employee’s first week of leave, which the original law would not have paid.

[MORE: View premium rate comparisons; view fiscal note]

Republican opposition, amendments

Republicans say the proposal indicates the program is already in trouble and proof the state cannot accurately determine the right amount of payroll tax to adequately fund the program.

Citing the state’s problems rolling out other technology platforms, Rep. Bernie Perryman (R-St. Augusta) questions if the Department of Employment and Economic Development can get the IT systems in place in time for a 2026 launch. She unsuccessfully offered an amendment to delay program implementation by 12 months.

Rep. Dave Baker (R-Willmar) is concerned the bill does not propose changes needed to make the law less burdensome for small-business owners.

He said small employers will struggle under the law, especially if they don’t have enough employees to cover the duties of those taking paid leave or to quickly hire new workers to assume work duties.

The bill does give small employers a break, Frazier said, noting the premium rate for employers having 30 or fewer employees would be 75% of the annual premium rate calculated each year for larger employers.

Baker unsuccessfully offered an amendment to exempt employers with fewer than 20 employees from being required to participate in the paid leave program or to offer a comparable private plan.

“The math doesn’t work,” said Rep. Kristin Robbins (R-Maple Grove). She argued that nearly all 12 states that have previously enacted similar paid leave programs have seen costs spiral out of control. “We are so underestimating the cost of this program.”

To that end, she unsuccessfully offered an amendment to limit the maximum length of paid benefits from 20 weeks to 12, except in the case of complications from a pregnancy which would warrant an extra two weeks.

Rep. Anne Neu Brindley (R-North Branch) successfully offered an amendment that would require any annual actuarial analyses and updates be sent to chairs and ranking minority members of the legislative committees with jurisdiction over paid leave legislation.

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Speaker Emerita Melissa Hortman, husband killed in attack

By HPIS Staff House Speaker Emerita Melissa Hortman (DFL-Brooklyn Park) and her husband, Mark, were fatally shot in their home early Saturday morning.

Gov. Tim Walz announced the news dur...

House Speaker Emerita Melissa Hortman (DFL-Brooklyn Park) and her husband, Mark, were fatally shot in their home early Saturday morning.

Gov. Tim Walz announced the news dur...

Lawmakers deliver budget bills to governor's desk in one-day special session

By Mike Cook About that talk of needing all 21 hours left in a legislative day to complete a special session?

House members were more than up to the challenge Monday. Beginning at 10 a.m...

About that talk of needing all 21 hours left in a legislative day to complete a special session?

House members were more than up to the challenge Monday. Beginning at 10 a.m...