Dear Neighbors,

The first two weeks of the session have been productive, and I'm excited to share updates on our progress. In 2024, House DFL lawmakers will continue working side by side with neighbors and community members together – rooted in the values we all share – to lower the cost of living, deliver economic security for working families, and ensure everyone has the tools they need to thrive.

As we navigate the challenges ahead, this shared purpose is what fuels our drive and keeps us motivated. This week has been a powerful reminder of the collective good we achieve when we work together, and I'm excited to see what the rest of the year holds.

Thank you for the great honor of serving our vibrant community.

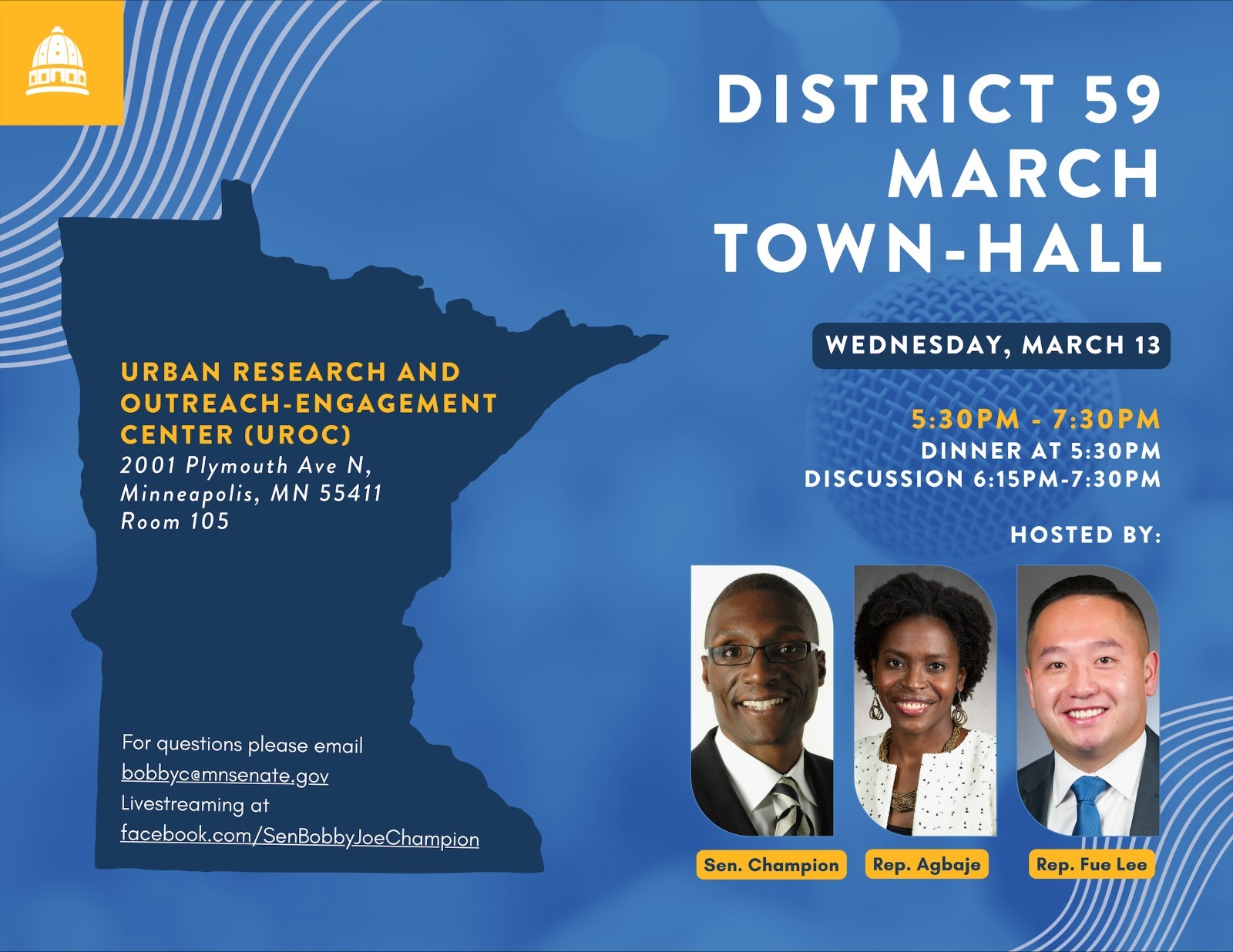

Save the Date

Join us for the next SD 59 Town Hall Meeting on Wednesday, March 13th at the University of Minnesota Urban Research and Outreach-Engagement Center (UROC). We'll be kicking off with a delicious complimentary meal and refreshments at 5:30 PM, followed by a legislative discussion starting at 6:15 PM. No registration is needed, so bring your questions, ideas, and appetite! We're excited to hear your thoughts and engage in a robust conversation about important issues facing our community.

Enacted Laws

This year began with several impactful bills taking effect, bringing positive changes to Minnesotans' lives. Including:

- Stronger tenant protections: New laws strengthen protections for renters, promoting fairer housing practices and stability for Minnesotans.

- Transparency in hiring: Prohibiting past pay disclosure in the hiring process helps combat wage discrimination and promotes fairer hiring practices.

- Free menstrual products: School districts and charter schools must now provide free menstrual products to students, ensuring period equity and removing a barrier to education.

- Earned sick and safe time: Nearly all workers in Minnesota now have the right to accrue paid sick and safe time, offering greater security and flexibility in managing personal needs.

- Gun violence prevention measures: Universal background checks for handgun sales and extreme risk protection orders. This means background checks are required for all private handgun sales, and family members/law enforcement can petition courts to temporarily remove firearms from individuals deemed a danger to themselves or others.

- Pay increases for home care workers

This list just scratches the surface. Last year we made historic movements that will improve the lives of all Minnesotans, like paid family medical leave, providing free school meals for students, codifying reproductive freedom, and providing emergency funding for food shelves across the state. You can learn more about the different bills that were enacted on January 1, 2024, here.

If you have questions or need support in locating available resources, please don’t hesitate to contact my office at rep.esther.agbaje@house.mn.gov or 651-296-8659.

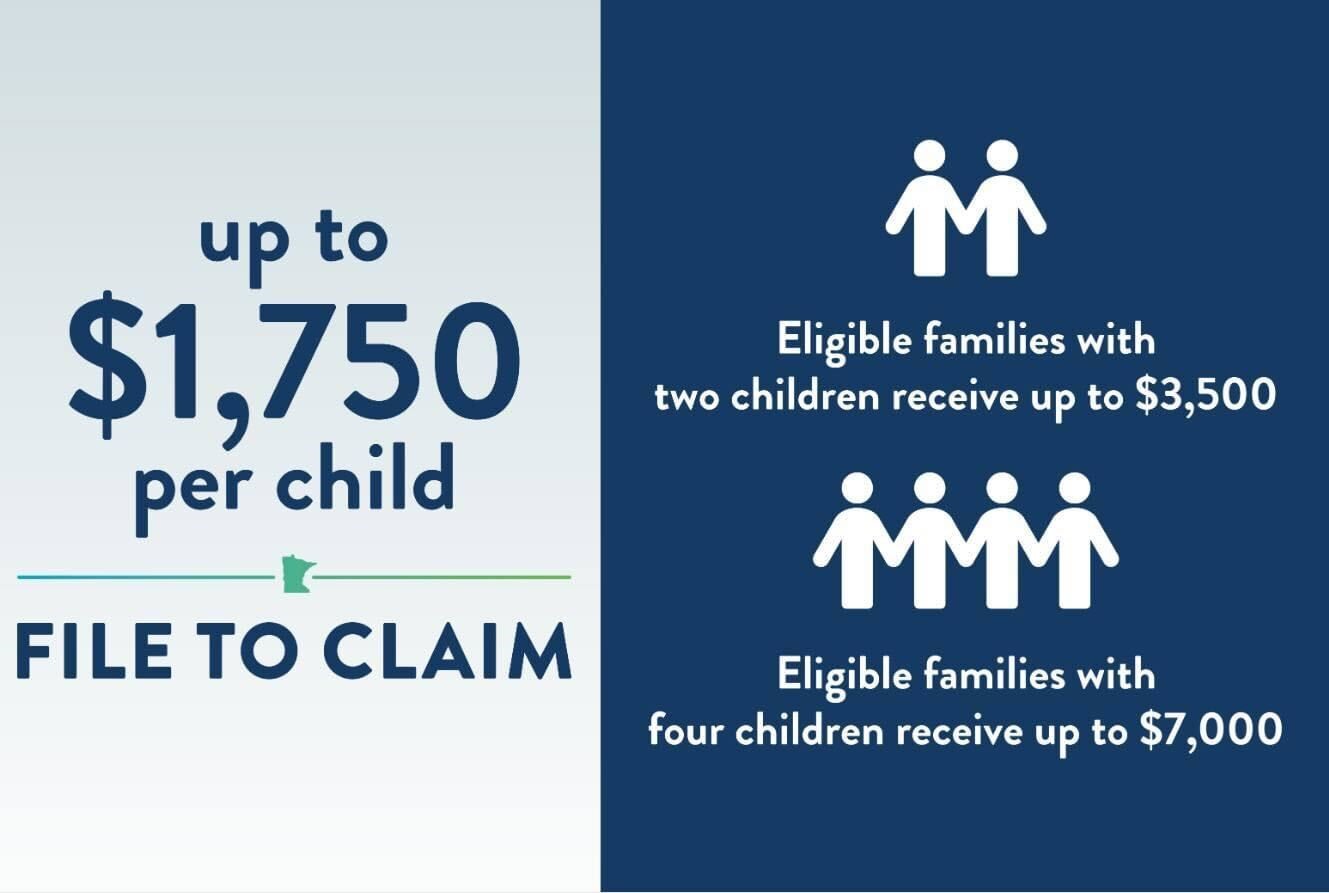

Child Tax Credit

For all tax filers, this credit begins to phase out at an income level of $35,000 and fully phases out at a maximum of $90,750 for a family with four children. I am proud of our nation-leading Child Tax Credit providing Minnesota families with much-needed relief. Families will save up to $1,750 for each dependent. Democrats are cutting child poverty by one-third with this rebate. You can claim the tax credit by filing a 2023 income tax return. The $1,750 credit is for each child 17 years old and younger, with no limit on the number of children.

Visit the Minnesota Department of Revenue website for more information.

Reproductive Freedom Caucus

It was an honor to speak at the Reproductive Freedom Caucus press conference, this week, to highlight the importance of increasing positive outcomes for Black Maternal Healthcare.

As the new Chair of the Black Maternal Health Caucus, this year, we will be purposeful in ensuring that reproductive health care access is just and equitable, not only for those with means and privilege but for any person seeking to have and support a family.

Black Maternal Healthcare

This week, the Minnesota House Black Maternal Health Caucus (BMHC) unveiled our 2024 legislative agenda, an inclusive package of bills designed to address the persistent inequities Black birthing people face and empower all families during the sacred journey of childbirth.

The BMHC is committed to working to pass these critical bills and invest in the health and well-being of all birthing people. Black mothers deserve the right to safe and respectful childbirth experiences, and the BMHC will continue to fight for policies to make that vision a reality.

Renter’s Credit

As a member of the Taxes Committee, I want to remind you that you may be eligible for the Renter's Credit when you file your taxes this year. This year the renter’s credit will be filed on the same form as your income return, you won’t need to fill out a separate form to send in later. It also means that the refund will come at the same time as any other tax refund you may qualify for. You can apply using your Certificate of Rent Paid, which all landlords are required to provide.

I encourage you to explore this program and see if it can offer you valuable tax relief. The Renters’ Credit refunds a portion of the property taxes that renters have paid through their rents. The credit is particularly targeted to the state’s lowest-income households; over 60 percent of households receiving the credit have incomes of $40,000 or less. The maximum household income to qualify for the Renters’ Credit for the 2021 tax year was $64,920.

By providing property tax refunds to qualifying homeowners and renters, the state of Minnesota helps bring down one of the costs of housing and creates a more equitable tax system. Learn more on the Department of Revenue website.

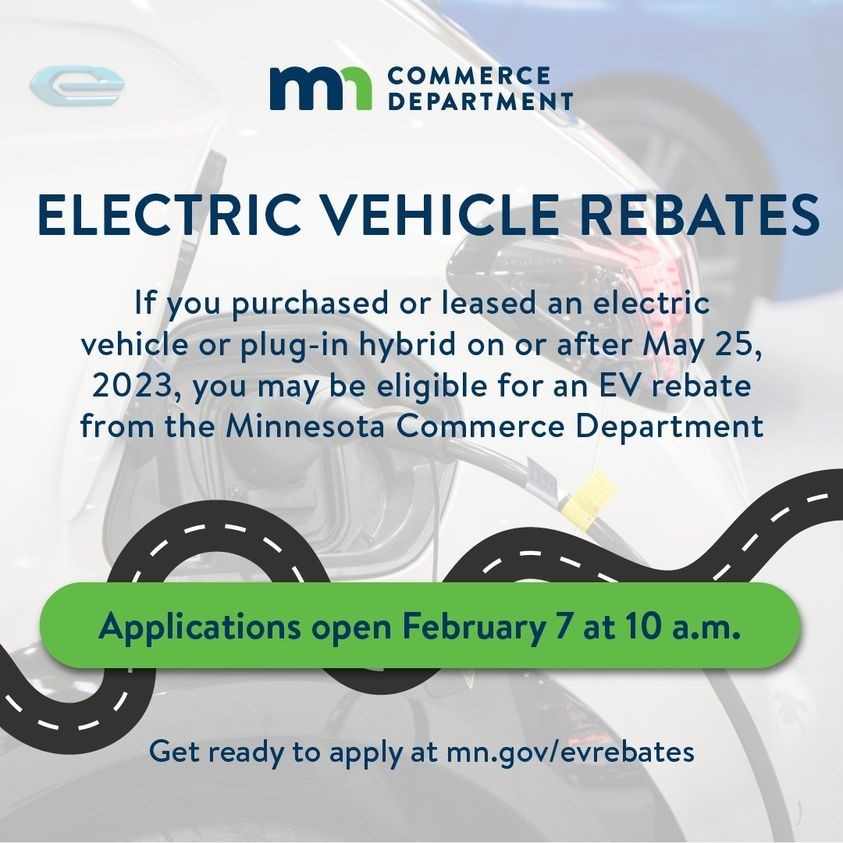

Electric Vehicle Rebates

Last session DFLers passed an Electric Vehicle Rebate Program allowing residents to receive a rebate of up to $2,500 for a new EV purchase and $600 for a used purchase. Electric cars, plug-ins or hybrids purchased or leased on or after May 25, 2023, are eligible. Applications are now live, and you can find more information at https://mn.gov/evrebates.

Let’s Stay Connected!

Please reach out with any input, ideas, or feedback about the issues important to you. If you need assistance, scheduling a meeting, or have questions, feel free to email me at rep.esther.agbaje@house.mn.gov or call 651-296-8659.

In community,

Rep. Esther Agbaje

Minnesota House of Representatives (59B)

Committee Assignments:

- Vice Chair Housing Finance and Policy

- Taxes

- Ways and Means

- Elections Finance and Policy

Legislative Assistance

Shamat Abraha

shamat.abraha@house.mn.gov

651-296-7189