House health panel approves proposal to provide medical debt relief

Nearly 60% of people with medical debt have chosen not to get care due to cost.

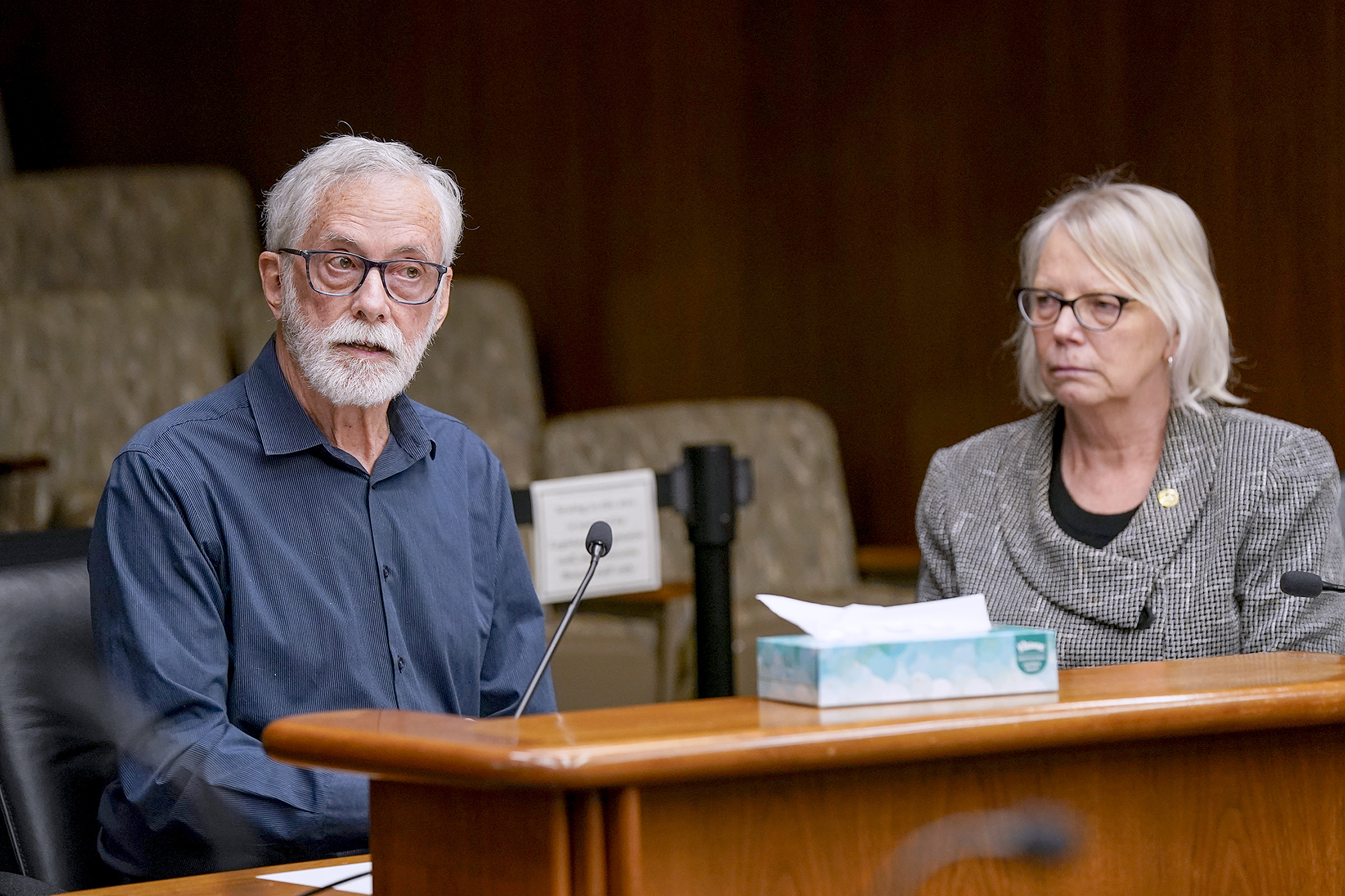

Rep. Liz Reyer (DFL-Eagan) quoted that information from a study by the Peterson Center on Health Care while presenting HF1814 Thursday to the House Health Finance and Policy Committee.

Part of the Minnesota Debt Fairness Act, the bill would establish provisions to make medical debt more manageable for Minnesotans, including individuals who have been burdened by their spouse’s medical debt.

The committee approved the bill, as amended, and referred it to the House Taxes Committee.

“This bill would help Minnesotans pay back their medical debt fairly and affordably without falling into poverty, bankruptcy, and further health crises in the process,” said Assistant Attorney General Bennett Hartz.

Hartz said the bill would:

- allow patients to seek medically necessary care regardless of whether they have medical debt;

- prohibit reporting of medical debt to credit bureaus;

- reduce interest on medical debt from the current cap of 8% to 4%;

- abolish the mandate that married individuals automatically assume their spouse’s medical debt; and

- prohibit debt collectors from using false and misleading statements and threats to induce someone to pay a medical debt payment.

Walt Myers turned to Cancer Legal Care – an organization that helps clients impacted by the disease navigate legal challenges – when the $135,000 bill for his deceased wife’s cancer treatment far exceeded what his insurance plan said he should owe.

“The elimination of Sue’s medical debt was life-changing for me,” he said.

Reyer said people with medical debt are more likely to have no savings, be overdrawn, have credit card debt, use payday loans, or be contacted by debt collectors. Blacks and people with disabilities are more apt to have medical debt, she added.

“People need to be able to afford their lives,” Reyer said. “At the same time, health care providers need to be able to depend on people paying their bills. These two goals do not have to be in conflict. However, too many people are saddled with unmanageable medical debt.”

Representatives of 10 organizations submitted letters of support.

Rep. Tina Liebling (DFL-Rochester), the committee chair, said the proposal is a “vehicle bill.” She said a related and more complicated bill is before the House Commerce Finance and Policy Committee, but the health committee needed to hear the portion of that bill contained by the vehicle bill.

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Speaker Emerita Melissa Hortman, husband killed in attack

By HPIS Staff House Speaker Emerita Melissa Hortman (DFL-Brooklyn Park) and her husband, Mark, were fatally shot in their home early Saturday morning.

Gov. Tim Walz announced the news dur...

House Speaker Emerita Melissa Hortman (DFL-Brooklyn Park) and her husband, Mark, were fatally shot in their home early Saturday morning.

Gov. Tim Walz announced the news dur...

Lawmakers deliver budget bills to governor's desk in one-day special session

By Mike Cook About that talk of needing all 21 hours left in a legislative day to complete a special session?

House members were more than up to the challenge Monday. Beginning at 10 a.m...

About that talk of needing all 21 hours left in a legislative day to complete a special session?

House members were more than up to the challenge Monday. Beginning at 10 a.m...