DFLers call transportation package a ‘generational investment’ as House gives a green light

Planes, trains and automobiles. And bicycles, buses and pedestrians.

Funding for pretty much every type of travel is included in the conference committee report on HF2887, passed 69-61 by the House Sunday.

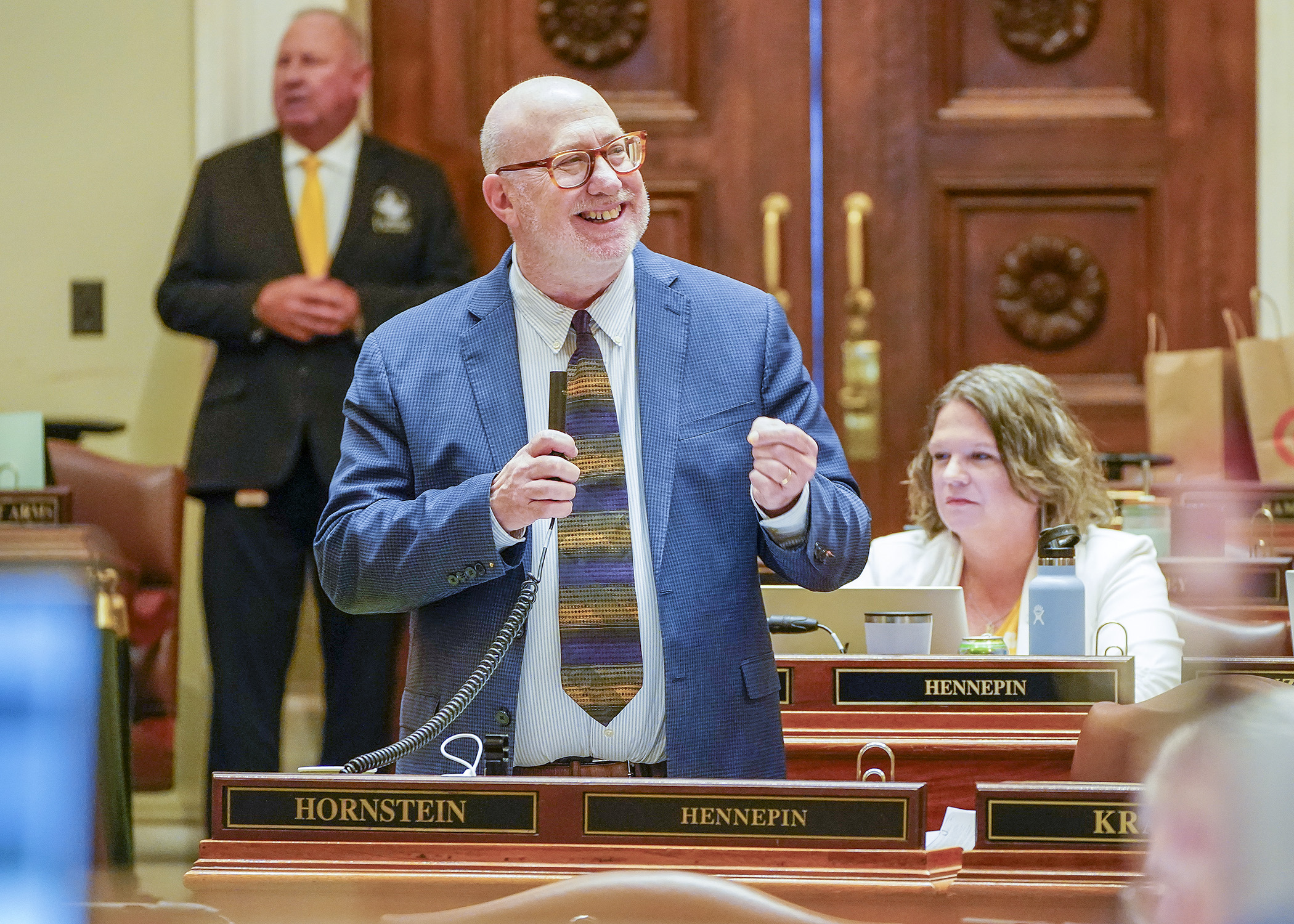

Addressing what Rep. Frank Hornstein (DFL-Mpls) called “decades of neglect,” the transportation finance and policy bill aims to build a safer, more equitable, more sustainable transportation system.

“We go big. We go bold. We make that generational investment today,” said Hornstein, who sponsors the bill with Sen. D. Scott Dibble (DFL-Mpls).

Appropriations in the next biennium would include $7.85 billion for the Department of Transportation and $579.47 million for the Department of Public Safety.

The bill would also authorize $599.2 million derived from trunk highway bond sales. Of this, $200 million would go to state road construction, $166.15 million to named projects, and $145 million for Corridors of Commerce program.

Scores of projects and groups would receive new or increased funding including Highway 65 intersection improvements, Northern Lights Express, Stone Arch Bridge improvements, deputy registrars, bike paths, bus rapid transit, traffic safety council, speed camera studies, free bus fare transit pilot project, state patrol helicopter, pedestrian bridge over Highway 62, microtransit operations, and electric vehicle infrastructure.

Hornstein said historic proposals in the bill would provide for an ongoing funding stream for small cities, a rural highway safety program and nation-leading policies that link climate, land use, and transportation.

Tax and fees

Also included would be revenue raisers in the form of an increased gas tax, a 0.75% metro-area sales tax increase, a new fee on deliveries, and higher registration and driver’s license fees.

Rep. Kurt Daudt (R-Crown) said the fee and tax increases are unnecessary.

“We are collecting enough money right now to fix our roads and bridges without questions,” he said. “This bill is out of touch with where we are at this time, in this state and with this budget.”

Minnesota would join Colorado in imposing the type of delivery fee proposed, beginning July 1, 2024. The bill includes a 50-cent fee on deliveries costing more than $100 with exceptions for food – including restaurant deliveries – baby products, drugs and medical devices. Retailers with less than $1 million in annual sales would be exempt.

Money collected would go into a Transportation Advancement Account with 36% designated to metropolitan counties, 27% to small cities, 15% to larger cities, 11% to town roads, 10% to the county state-aid highway fund and 1% as grants to food assistance programs such as Meals on Wheels.

Rep. Erin Koegel (DFL-Spring Lake Park) sponsors the bill which proposed a 75-cent fee, without a minimum, that aimed to have people think about how many orders they place per week. The minimum may encourage people to split up orders and erase the co-benefit of fewer delivery trucks on the roads. She said it is a new revenue source as fleet fuel efficiency increases.

Other policy provisions would:

- establish Lions Club International and professional sports foundation license plates;

- exempt veterans with 100% disability from vehicle registration and delivery fees;

- create an Advisory Council on Traffic Safety;

- allow remote options for driver’s education;

- rebalance Corridors for Commerce regional funding; and

- designate the Deputy Josh Owen Memorial Overpass.

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Speaker Emerita Melissa Hortman, husband killed in attack

By HPIS Staff House Speaker Emerita Melissa Hortman (DFL-Brooklyn Park) and her husband, Mark, were fatally shot in their home early Saturday morning.

Gov. Tim Walz announced the news dur...

House Speaker Emerita Melissa Hortman (DFL-Brooklyn Park) and her husband, Mark, were fatally shot in their home early Saturday morning.

Gov. Tim Walz announced the news dur...

Lawmakers deliver budget bills to governor's desk in one-day special session

By Mike Cook About that talk of needing all 21 hours left in a legislative day to complete a special session?

House members were more than up to the challenge Monday. Beginning at 10 a.m...

About that talk of needing all 21 hours left in a legislative day to complete a special session?

House members were more than up to the challenge Monday. Beginning at 10 a.m...